India is the leading country in making digital transactions. Demonetization and COVID played a crucial role in switching people from cash transactions to cashless transactions. With the Unified Payment Interface (UPI), digital transactions are now easier than ever. Be it a 10 rs chocolate or some expensive electronic gadgets worth lakhs, we’re habituated to scanning the UPI QR code for payment.

People are so habituated to these UPI apps, as they use them as full-featured expense-splitting apps as well, where they can split their expenses with friends and keep track of it. With the increased UPI Payments, there are a large number of cases being registered about Wrong UPI Transactions. Learn how to reverse wrong UPI Transactions on GPay, Paytm, PhonePe, etc.

What should be the first step after Wrong UPI Transactions?

The Reserve Bank of India (RBI) has issued an advisory to help people with unintentional UPI transactions. In case of Wrong UPI Transactions, the first step is to report the transactions to the platform where the transaction is done, such as GPay, Paytm, PhonePe, etc.

Every payment platform has this option in its Help section to guide users for unintentional UPI transactions. According to RBI, the payment platform is bound to guide users for Wrong UPI Transactions.

Contact the Bank for Wrong UPI Transactions

After registering the complaint to the payment platform, you need to immediately contact your bank for unintentional UPI transactions. Register an official complaint with your bank via email/phone/ in-person with all required details of transactions. This includes transaction id, date/time of the transaction, UPI ID of the sender and unintentional receiver, etc. Inform your bank about this transaction and if possible keep the branch manager in a loop. Describe everything that occurred to the concerned authority of your bank.

If the UPI ID (the one where you send the money unintentionally) does not exist, the bank will reimburse the debited amount without any hesitation. If the UPI Id exists, the transaction would have been processed, and the amount must have been credited to the bank account connected with the unintentionally send UPI Id.

In this case, the bank needs to take permission from that account holder in order to reverse the wrong UPI transaction.

When both parties have accounts in the same bank, the process might be a little easy for your bank to connect with that person. Otherwise, the bank needs to connect with the receiver’s bank in order to reverse the wrong UPI transactions.

Without the receiver’s request, no bank can reverse the wrong UPI transactions. If the receiver does not allow the bank to reverse the payment, you have the option to choose legal ways.

Detailed Guide to Register a Complaint for Unintentional UPI Transactions on NPCI Website

The National Payments Corporation of India (NCPI), which facilitates UPI services, allows users to raise a complaint for disputed and wrong UPI transactions. You can register a complaint on NCPI’s website for both types of transactions – Fund Transfer and Merchant Transactions.

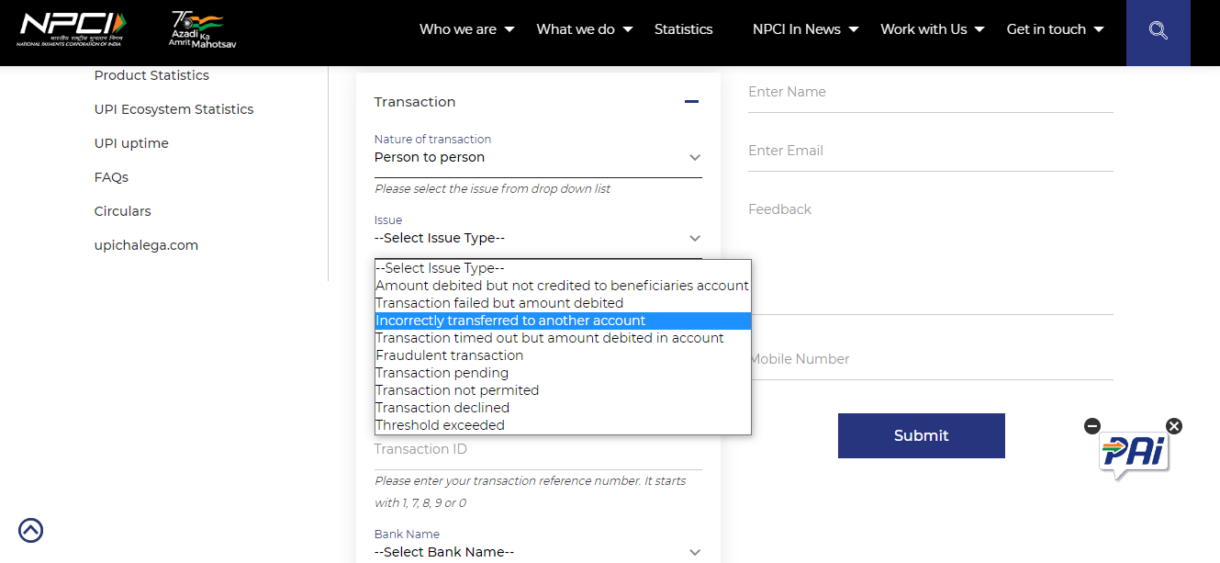

Here’s a step-by-step guide to registering a complaint for wrong UPI transactions.

- Open ncpi.org.in on your web browser.

- Select the Get in Touch option.

- Tap on the UPI Complaint option.

- You will be redirected to the UPI’s Dispute Redressal Mechanism.

- Now, in the complaint section, select the nature of the transaction – Person to peron or Person to merchant.

- After that select Incorrectly transferred to another account as the Issue type.

- Add other necessary details like Bank Name, VPA, Amount, Date of transaction, email, phone no, etc. You also need to attach an updated bank account statement.

- Click on the Submit.

If all the above-mentioned authorities and platforms do not resolve your query regarding wrong UPI transactions, the last step is to register a complaint with RBI’s Ombudsman for Digital Transactions.

Also Read – How To Make UPI Payment Without Internet?

Frequently Asked Questions (FAQs)

I’ve unintentionally sent money to the wrong UPI id. Where should I complain first?

The first step to raise an issue is the payment app (GPay, PhonePe, Paytm, etc.) from which you made a wrong UPI payment.

The payment app and Bank is not helping me to reverse the wrong UPI transaction. What should I do now?

You can raise the issue on the NPCI website, and along with that, you can register a complaint with RBI’s Ombudsman.

Who is the RBI’s Ombudsman for Digital Transactions?

Reserve Bank of India has appointed a senior official to resolve customer complaints against system participants as Ombudsman for Digital Transactions.

How can we lodge a complaint to RBI Ombudsman?

You can file the complaint on the official website of RBI.

Also Read – What are Virtual Credit Cards? Everything You Need to Know!

Conclusion

That’s what will keep you worry-free next time when you unintentionally send money to the wrong UPI address, as you’ve learned how to reverse wrong UPI transactions on GPay, Paytm, PhonePe, etc. Share your valuable feedback with us to help us serve you better.